As the world becomes increasingly aware of the urgent need for sustainable and eco-friendly business practices, microfinance is emerging as a powerful tool for promoting such initiatives. Microfinance, which provides financial services to low-income individuals and small businesses, can be used to support sustainable and environmentally responsible ventures that may otherwise struggle to secure funding. Here we explore how microfinance can be used to promote sustainable and eco-friendly businesses, and the benefits and challenges of such an approach.

What Is Microfinance?

Microfinance is a financial service that provides small loans, savings accounts, and insurance to individuals and small businesses who are typically excluded from traditional banking services. It aims to help low-income individuals and entrepreneurs to start or expand their businesses, and provide financial stability and security.

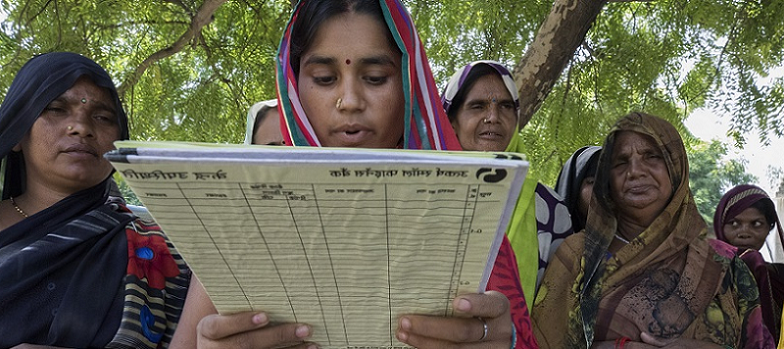

Microfinance institutions, such as microfinance banks, credit unions, and NGOs, offer a range of financial services, including credit, savings, and insurance, tailored to the specific needs of their clients. Microfinance is often associated with social impact and poverty alleviation, as it targets individuals and businesses in underserved and marginalized communities.

Microfinance institutions also aim to be sustainable and profitable, generating sufficient returns to fund their operations and expand their reach. While microfinance has been the subject of criticism and controversy, it remains a widely used and impactful tool for promoting financial inclusion and economic development.

The Role of Microfinance in Sustainable Development

Microfinance plays a critical role in sustainable development by providing financial services to entrepreneurs and small businesses in underserved and marginalized communities. By giving access to credit, savings, and insurance, microfinance institutions enable individuals to start or expand their businesses, create jobs, and generate income. This, in turn, contributes to economic growth, poverty reduction, and improved living standards.

Microfinance institutions also promote sustainable development by prioritizing the needs of their clients, many of whom are engaged in environmentally sensitive or socially responsible businesses. By investing in these ventures, microfinance institutions support the development of sustainable and eco-friendly practices, reducing the negative impact on the environment and society.

Microfinance institutions often partner with other organizations, including government agencies and NGOs, to provide additional support to their clients, such as training and technical assistance. Overall, microfinance is a vital tool in promoting sustainable development, creating economic opportunities, and improving the quality of life for individuals and communities around the world.

Eco-Friendly Businesses and Microfinance

Microfinance can play a critical role in promoting eco-friendly businesses by providing financial services to entrepreneurs and small businesses engaged in environmentally responsible practices. Eco-friendly businesses use sustainable and environmentally-friendly practices to minimize the negative impact of their operations on the environment and society.

Microfinance institutions can support these businesses by offering loans, savings accounts, and insurance tailored to their specific needs. By providing access to finance, microfinance institutions enable entrepreneurs to invest in environmentally-friendly practices, such as renewable energy, sustainable agriculture, and waste management. This, in turn, contributes to sustainable development, creating jobs, generating income, and reducing poverty while promoting environmental sustainability.

Eco-friendly businesses can also benefit from partnerships with microfinance institutions, which often provide additional support, such as training and technical assistance, to help them develop their businesses and maximize their impact. Microfinance can be an effective tool in promoting eco-friendly businesses, reducing the negative impact of business operations on the environment, and promoting sustainable development.

Examples of Successful Eco-Friendly Businesses and Microfinance

There have been many successful stories of microfinance in sustainable development. Microfinance has played a critical role in promoting sustainable businesses and reducing poverty in underserved and marginalized communities throughout the world. Several organizations have provided financial services to entrepreneurs engaged in environmentally-friendly and socially responsible businesses, helping to create jobs, generate income, and improve living standards while promoting sustainable development.

Microfinance has proved to be an effective tool in providing access to finance to individuals and small businesses that would otherwise be excluded from traditional banking services, enabling them to contribute to sustainable development and reducing poverty.

- Grameen Bank, Bangladesh: Grameen Bank is a pioneer of microfinance, providing financial services to poor individuals in rural Bangladesh. It has helped to promote sustainable development by offering small loans to entrepreneurs who use environmentally-friendly practices, such as organic farming or producing biodegradable products.

- Pro Mujer, Latin America: Pro Mujer is a microfinance organization that primarily focuses on empowering women entrepreneurs in Latin America. It offers microloans, health services, and education to its clients, with a strong emphasis on environmental sustainability and social responsibility.

- FINCA International, Africa: FINCA International is a microfinance organization that provides financial services to low-income individuals and small businesses in Africa. It has worked to promote sustainable development by offering loans to entrepreneurs who use renewable energy, water conservation, and other environmentally-friendly practices.

- Kiva, Worldwide: Kiva is a microfinance platform that allows individuals to lend money to entrepreneurs in developing countries. It has supported numerous sustainable development initiatives, including renewable energy projects, sustainable agriculture, and eco-friendly businesses.

- Root Capital, Latin America and Africa: Root Capital is a nonprofit social investment fund that provides financing and training to small and growing businesses in rural areas of Latin America and Africa. It has invested in businesses engaged in sustainable agriculture, renewable energy, and other environmentally responsible practices.

Challenges in Promoting Sustainable and Eco-Friendly Businesses through Microfinance

While microfinance can be a powerful tool for promoting sustainable and eco-friendly businesses, there are several challenges that need to be addressed to ensure its effectiveness. One of the main challenges is the lack of awareness and understanding of environmental sustainability among entrepreneurs, which can limit their adoption of eco-friendly practices.

Another challenge is the limited technical expertise of microfinance institutions in assessing the environmental impact of businesses and supporting their eco-friendly initiatives. In addition, the lack of funding and investment for eco-friendly businesses can make it difficult for them to scale and compete in the market.

Microfinance institutions also face challenges in accessing funding and resources to support their operations, limiting their ability to provide services to underserved communities. External factors such as climate change, political instability, and economic shocks can affect the sustainability of businesses and the overall effectiveness of microfinance programs. Addressing these challenges requires a collaborative effort from microfinance institutions, entrepreneurs, policymakers, and other stakeholders.

Strategies to overcome these challenges include providing environmental training and technical assistance to entrepreneurs, promoting public-private partnerships to fund eco-friendly businesses, increasing access to funding and resources for microfinance institutions, and developing policies that support sustainable and environmentally responsible businesses. Overall, addressing the challenges of promoting sustainable and eco-friendly businesses through microfinance is critical to ensure the success and impact of these initiatives.